Are you seeking a flexible credit card that works well in Germany without the usual hidden fees?

The TF Bank Credit Card offers a simple application process, no annual fee, and complete control through your phone.

In this guide, you’ll learn exactly how to apply and what makes this card a smart choice.

What Makes This Card Worth Considering

If you’re looking for a simple, practical credit card with no strings attached, this one deserves your attention.

Here are the main reasons people in Germany are choosing the TF Bank Credit Card:

- No annual fee – You never pay to keep the card active.

- Flexible repayment – Choose how much to pay back each month based on what works for you.

- Up to 51 days interest-free – If you pay the full balance on time, you avoid interest charges.

- Fully digital control – Manage everything via the TF Bank app or online portal.

- Google Pay and Apple Pay support – Easy contactless payments straight from your phone.

- No fees for standard online purchases – Everyday use won’t cost extra.

- Quick approval process – Most applicants get an answer within minutes.

- Transparent terms – The fees and rules are clearly explained, with no hidden traps.

Who Can Apply

Before you start the application, meet a few basic conditions.

These requirements help ensure you’re eligible and improve your chances of getting approved:

- You must live in Germany.

- You need to be at least 18 years old.

- A steady source of income is required.

- You should have a clean or stable Schufa (credit history).

- A valid German bank account is necessary.

- You must provide a government-issued ID.

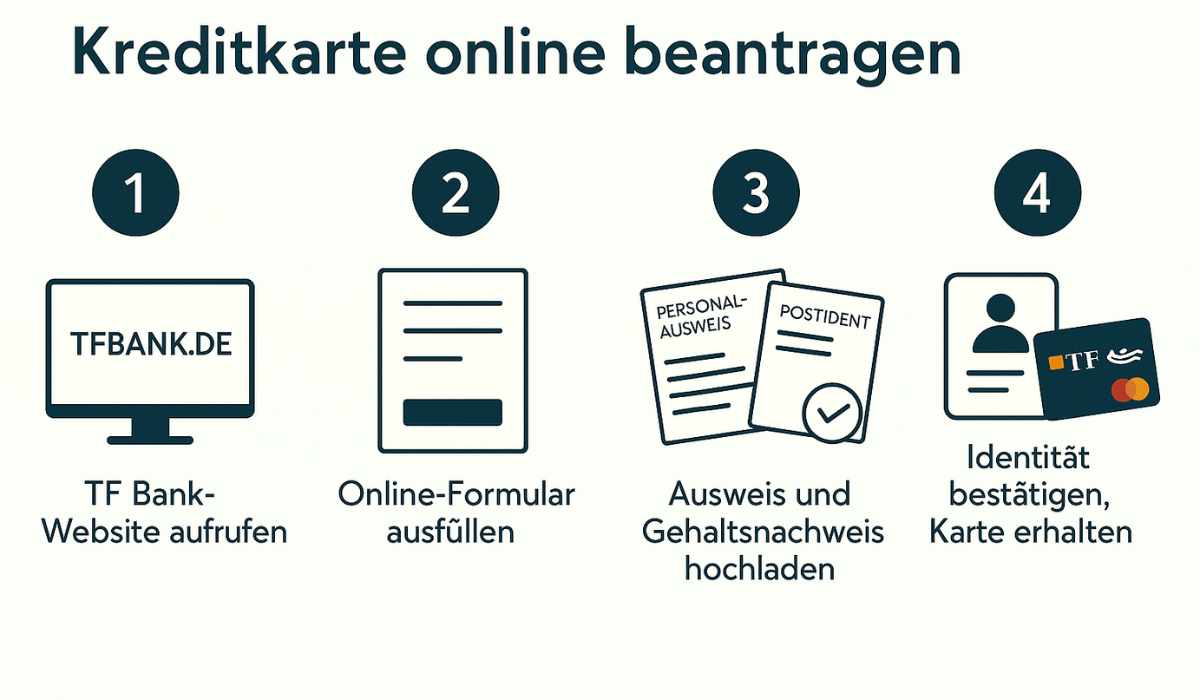

Step-by-Step: How to Apply

The entire application is done online and only takes a few minutes. Here’s a quick breakdown of what to expect during the process:

- Go to the official German website – Start the application on the bank’s secure page.

- Fill out the form – Enter your personal, contact, and financial details.

- Submit documents – Upload your ID and proof of income if requested.

- Verify your identity – Complete VideoIdent or PostIdent for identity confirmation.

- Wait for approval – You’ll usually get a response within a few minutes or hours.

- Receive your card by mail – Once approved, the physical card is sent to your address.

What You’ll Need on Hand

Prepare a few essential documents in advance to expedite the application process and minimize delays. Here’s what you should have ready:

- Valid ID – Passport or German Personalausweis (ID card).

- Proof of income – Recent payslips or tax return.

- Proof of address – A utility bill or Meldebescheinigung (registration certificate).

- Bank account details – IBAN of your German bank account.

- Smartphone or computer – For online application and identity verification.

Interest Rates and Fees You Should Know

While the card offers several cost-saving benefits, it’s essential to understand the interest rates and potential fees associated with its use:

- No Annual Fee: There is no annual fee for maintaining the card.

- Interest-Free Period: Purchases are interest-free if the full balance is paid within 51 days.

- Interest on Purchases: If the balance is not paid in full within the interest-free period, an effective annual interest rate of 24.79% applies.

- Cash Withdrawals: No fees are charged for cash withdrawals; however, interest accrues immediately at an effective annual rate of 24.79%.

- Minimum Repayment: The minimum monthly repayment is 3% of the outstanding balance, with a minimum of €30.

- Foreign Transactions: There are no additional fees for payments in foreign currencies.

Everyday Use Cases (How You Might Use It)

This card isn’t just about having credit—it’s designed for real-life spending.

Whether you’re managing bills or planning something bigger, here are some simple ways you might use it:

- Grocery shopping – Pay now, repay later without interest if paid in full.

- Online purchases – Use it for secure payments on local or international websites.

- Travel bookings – Reserve hotels or flights with added flexibility.

- Emergency expenses – Handle urgent costs like repairs or medical bills.

- Subscription services – Keep monthly streaming or service charges in one place.

- Split larger buys – Spread out repayments for electronics or appliances.

- Cash withdrawals – Access cash when needed, with interest starting immediately.

What Sets TF Bank Apart in Germany

While there are many credit card providers out there, a few things make TF Bank stand out, especially for customers in Germany. Here’s what makes it different:

- Fully digital experience – Everything from application to account management is handled online.

- No annual fees – Unlike many banks, you won’t pay to keep the card active.

- Transparent terms – Clear, straightforward conditions with no hidden surprises.

- Quick approval process – Many applicants receive a decision within minutes.

- Nordic reliability – TF Bank is based in Sweden and regulated across the EU.

- Strong local support – Dedicated German-language customer service available by phone and email.

- Good reputation in Germany – Positive reviews highlight ease of use and simple setup.

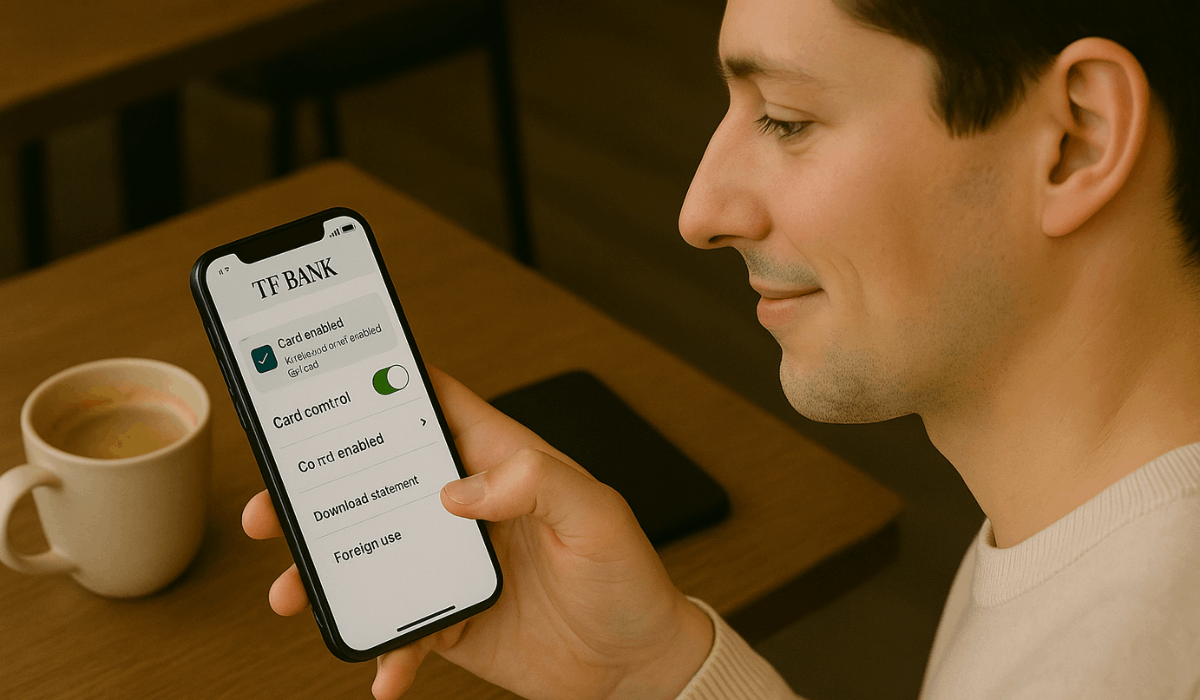

Managing Everything from Your Phone

Once your card is active, you can perform almost everything directly from your mobile device. Here’s what you can control using the app or online dashboard:

- Track spending in real time – See all your transactions instantly.

- Check available credit – Always know how much you have left to use.

- Download monthly statements – Access and save your records anytime.

- Make repayments – Pay off part or all of your balance directly from the app.

- Set limits and alerts – Customize spending caps and get notified for each transaction.

- Freeze or unfreeze your card – Lock your card temporarily if it’s lost or stolen.

- Turn on or off foreign use – Control where and how your card can be used abroad.

Need Help? Here’s Who to Contact

Support is easy to reach if you have questions or run into issues. Here’s how you can get assistance:

- Customer Service Hotline – Call the German support line at 030 46699708 during business hours.

- Email Support – Send a message to [email protected] and get a reply within 1–2 business days.

- Help Center – Browse FAQs and guides on the official website.

- Mailing Address: TF Bank AB, Postfach 11 02 28, 10832 Berlin, Deutschland.

- Account Messages – Use the secure inbox in your online account for direct support.

Before You Apply – A Few Smart Tips

A little preparation can improve your chances of approval and help you avoid delays. Keep these tips in mind before starting the application:

- Check your Schufa score – Ensure your credit history is in good standing.

- Prepare your documents – Gather your ID, proof of income, and address in advance.

- Apply only when ready – Submitting multiple applications within a short time can harm your credit.

- Use accurate information – Double-check all entries to avoid rejections.

- Understand the repayment terms – Know how much and when you must pay.

- Compare options – Ensure this card aligns with your financial needs.

- Set up online banking access – You’ll need it to manage your card efficiently.

To Conclude

TF Bank offers a flexible and straightforward credit card that fits well with everyday needs in Germany.

The TF Bank Credit Card has no annual fees, clear terms, and a fully online application process.

If you’re ready to apply, visit the official website and start your application in just a few minutes.

Disclaimer

Approval is subject to credit assessment and eligibility criteria, including a check with Schufa.

Terms, interest rates, and fees may change, so always refer to the official TF Bank website for the most current information.