LightStream home improvement loans have become a top option for homeowners seeking reliable financing. In 2025, rising renovation costs make fast, flexible loans more important than ever.

This review explains everything you need to know about LightStream’s terms, features, and requirements. By the end, you will understand if this loan suits your financial needs.

What Is a Home Improvement Loan?

Home improvement loans provide funds for renovation, repair, and remodeling projects. They are typically unsecured personal loans, meaning you don’t need collateral.

These loans are issued by banks, credit unions, and online lenders. For many borrowers, they are a fast, hassle-free way to cover project costs.

Why People Use It in 2025?

In 2025, homeowners face high costs for construction and repairs. A loan allows you to start projects quickly without waiting to save.

It also helps manage large expenses with predictable payments. Borrowers prefer them over credit cards due to lower interest rates.

Key Features of LightStream Home Improvement Loans

LightStream loans offer unsecured financing with no hidden charges. Its unique structure gives homeowners flexibility and speed.

Every feature is designed to simplify the borrowing process. Here are the main benefits available in 2025.

No Fees or Equity Requirements

Borrowers do not need home equity to qualify for LightStream loans. You also avoid appraisal fees, application fees, and prepayment penalties.

This makes the product accessible to more homeowners. Eliminating extra charges keeps costs predictable.

Loan Amounts and Terms

LightStream offers loan amounts from $5,000 to $100,000. Repayment terms extend up to 20 years, giving borrowers flexibility.

The wide range allows you to fund small projects or major renovations. Flexible timelines help fit payments into your budget.

Same-Day Funding

Funding speed is one of LightStream’s strongest features. If approved, you may receive funds the same day you apply.

This allows you to start projects immediately without delay. Few traditional lenders can match this quick turnaround.

Paperless Application Process

The loan application is entirely online. You can apply from a smartphone, tablet, or computer.

The process requires minimal documentation and uses e-signatures. This makes it convenient and faster than paper-based methods.

Interest Rates in 2025

Interest rates are the biggest factor when choosing financing. LightStream emphasizes stability with fixed-rate loans.

Borrowers in 2025 can still expect competitive offers. Let’s explore what makes their rates stand out.

Fixed Rates Advantage

With fixed rates, your payment stays the same each month. This stability is useful when market conditions shift.

Homeowners can plan budgets without worrying about sudden rate hikes. Predictable payments also reduce long-term stress.

Comparison to Market Averages

LightStream rates are often lower than credit cards and competitive with HELOCs. Credit cards may exceed 20% APR, while LightStream often remains in the single digits for qualified borrowers.

Market averages in 2025 show LightStream as a strong option. This difference saves you significant money over time.

Rate Beat Program

LightStream offers a Rate Beat Program. If you find a competitor with a lower rate, LightStream will attempt to beat it.

This guarantees you are not overpaying for financing. It’s a feature that builds confidence for borrowers.

Eligibility and Requirements

Understanding eligibility helps you prepare before applying. LightStream focuses heavily on borrower creditworthiness.

Unlike secured loans, your home is not required as collateral. Instead, the emphasis is on your financial history.

Credit Score

LightStream targets applicants with good to excellent credit. This generally means a FICO score above 660.

Stronger credit scores result in lower interest rates. If your credit is weaker, approval may be difficult.

Income and Cash Flow

Lenders review your income and ability to manage payments. Applicants should demonstrate consistent earnings.

Having a clear budget also helps approval chances. Income stability is a key factor in loan decisions.

No Collateral

Borrowers are not required to pledge assets. Unlike a home equity loan, your property is not at risk.

Approval depends on your financial responsibility. This makes it safer for homeowners.

Pros and Cons of LightStream Loans

Every loan has strengths and drawbacks. LightStream is no exception. Borrowers should weigh both sides before applying. Here is a clear breakdown.

Advantages

LightStream provides fast funding and flexible repayment terms. The loan amounts are large enough for major projects.

No fees or equity requirements add convenience. Borrowers also benefit from transparent policies.

Disadvantages

Applicants with low credit may not qualify. Loan rates are tied to creditworthiness, limiting access.

LightStream also does not allow co-signers. These restrictions may exclude some borrowers.

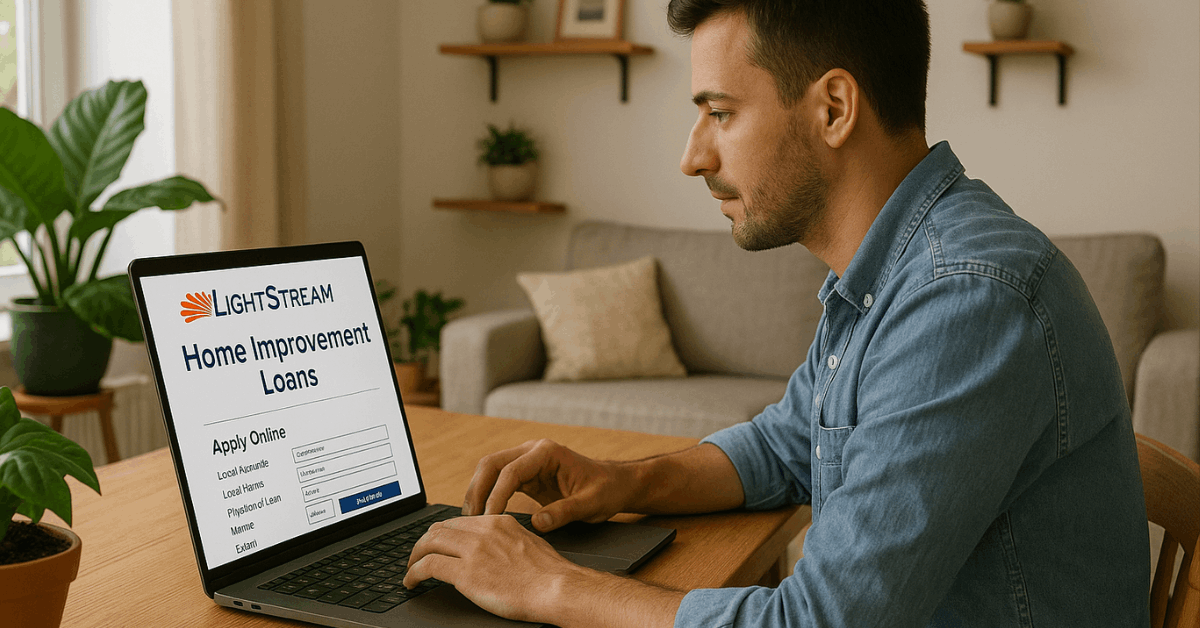

How Does a LightStream Home Improvement Loan Work?

The loan process is simple and digital. From application to funding, everything can happen quickly. Borrowers in 2025 can expect a streamlined experience. Here’s how the process works.

Step-By-Step Process

The loan application is quick and can be done entirely online. Here are the main steps you need to follow.

- Apply Online – Fill out the application from any device.

- Receive Decision – Get a response within business hours.

- E-sign Agreement – Accept terms electronically.

- Receive Funds – Money can be deposited the same day.

Example Timeline

In many cases, funding is delivered in less than 24 hours. Traditional banks often take days or weeks.

LightStream’s speed helps you start work immediately. This is why it appeals to time-sensitive borrowers.

Comparing Loan Options

Homeowners often compare LightStream loans with other financing tools. Each option has unique advantages.

Understanding the differences ensures better choices. Let’s break down the comparisons.

LightStream vs. Home Equity Line of Credit (HELOC)

HELOCs allow you to borrow against your home’s equity. They usually offer lower interest but require significant paperwork.

LightStream requires no collateral and funds faster. For speed and convenience, it’s often the better option.

LightStream vs. Home Equity Loan

Home equity loans act as a second mortgage. They require collateral and equity ownership of at least 20%.

LightStream avoids these requirements, making approval easier. Borrowers prefer it when they lack equity.

LightStream vs. Credit Cards

Credit cards have much higher interest rates. Introductory offers may help, but costs rise after expiration.

LightStream’s fixed rates stay predictable. This makes it more affordable for large projects.

Who Should Consider This Loan in 2025?

LightStream home improvement loans are not for everyone. Borrowers with strong credit benefit the most.

It also suits people who need larger amounts quickly. Let’s explore the best and worst fits.

Best for

Borrowers with excellent credit scores receive the lowest rates. Those needing $10,000 or more for projects are ideal candidates.

Fast funding supports urgent repairs or upgrades. Responsible borrowers can maximize savings.

Not Best for

Applicants with weak credit will struggle to qualify. People with small projects may not need large loans.

In these cases, cash or credit cards may work better. This ensures LightStream loans are used efficiently.

Common Uses for LightStream Home Improvement Loans

Borrowers use these loans for different projects. The flexibility makes them attractive in 2025.

You can apply funds to nearly any home-related expense. Here are the most common uses.

Renovations

Kitchen and bathroom upgrades are top uses. Basements and living rooms also benefit.

Renovations increase property value. Borrowers often prioritize high-return improvements.

Repairs

Essential repairs like roofing and plumbing are common. Electrical updates also fall into this category.

Loans provide quick funding for emergencies. This helps prevent further property damage.

Additions

Some borrowers expand homes with garages or new rooms. Outdoor living projects are also popular.

Large additions require significant funding. LightStream loans cover these major expenses.

Repayment Terms and Flexibility

Repayment flexibility is important for budgeting. LightStream adapts terms to your needs. Payments are fixed each month. This makes it easier to plan ahead.

Installment Payments

Borrowers make monthly payments for the life of the loan. This structure is predictable and stable.

Payments do not fluctuate with market changes. It provides peace of mind for budgeting.

Term Options

Loan terms extend up to 20 years. Shorter terms suit smaller projects. Longer terms lower monthly payments but increase interest over time. Borrowers can choose based on their cash flow.

Customer Experience in 2025

Customer experience defines loan satisfaction. LightStream emphasizes convenience and transparency. Borrowers in 2025 continue to report positive feedback. Here’s what stands out.

Application Simplicity

The process is mobile-friendly and easy to navigate. Borrowers appreciate the lack of paperwork. Clear instructions reduce confusion. It’s accessible to a wide audience.

Funding Speed

Customers often highlight fast deposits. Receiving funds the same day is a major benefit. Competing banks rarely match this pace. It remains a key selling point.

Satisfaction Factors

No hidden fees improve trust. Borrowers also value fixed rates and flexible terms. Transparency helps maintain long-term satisfaction. Many report recommending LightStream to others.

LightStream Contact Information

Borrowers need accurate contact details for support. LightStream provides multiple ways to connect. Here are the main resources in 2025.

Phone

Customer service is available at 1-866-696-7578. Representatives can assist with applications and inquiries. It’s the quickest option for urgent questions.

Mailing Address

Borrowers can also use mail services. Address: LightStream, a division of Truist Bank, P.O. Box 117575, Atlanta, GA 30368-7575. Mail is slower but useful for official correspondence.

Website

Applications are processed at the official LightStream portal. It provides rate checking and secure account access. The website also lists current terms. Borrowers should always verify details there.

Disclaimer Section

Loan terms, rates, and eligibility requirements may change. This review is based on 2025 information.

Always confirm details on the official LightStream website before applying. Borrow responsibly and consider your financial situation first.

Conclusion – Final Thoughts on LightStream in 2025

LightStream home improvement loans provide speed, flexibility, and transparency. With amounts up to $100,000 and terms up to 20 years, they fit many large projects.

The loans are best for borrowers with strong credit who value fixed rates. In 2025, LightStream remains one of the most attractive lenders for home upgrades.