The Life Credit Card is a convenient financial tool for Japanese residents seeking to establish credit, earn rewards, and manage their daily expenses.

Whether you’re a resident or a long-term foreign national, this card is easy to apply for and designed for daily use.

Below is a detailed, step-by-step guide to help you understand the Life Card benefits and how to apply online.

Who Can Apply

Before starting the application, confirm you meet the eligibility criteria.

Basic Requirements:

- Age: You must be at least 18 years old.

- Residency: A valid Japanese address is required.

- Phone number: Must have a Japanese mobile phone number.

- Email address: An active email address is needed to receive confirmation and updates.

- Financial Criteria

- Employment: Full-time workers, part-timers, and students can apply.

- Income: While there’s no strict minimum, a stable income improves your chances.

- Guarantor: Students or applicants with low income may need a co-signer.

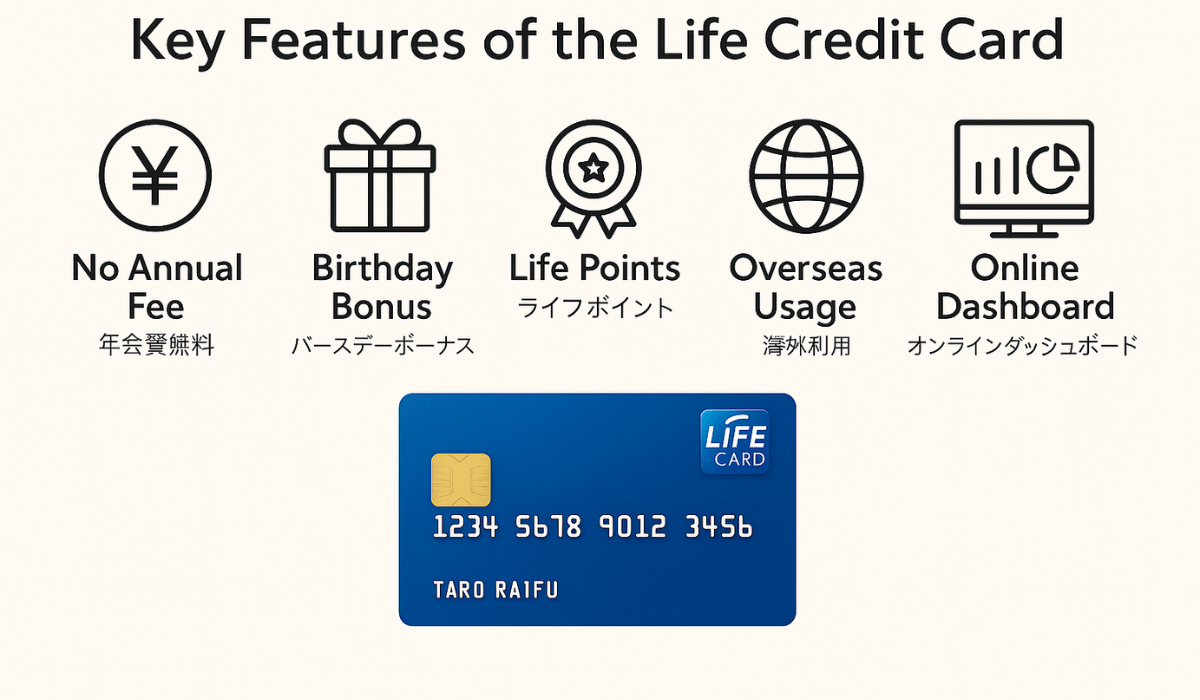

Key Features of the Life Credit Card

The Life Card comes with benefits that suit different lifestyles. Here are the main perks you’ll get after approval.

Card Benefits:

- Annual Fee: Free for the first year; may remain free if conditions are met.

- Point Program: Earn Life Points for every yen spent, redeemable for gift cards and services.

- Birthday Bonus: Extra points during your birthday month.

- Overseas Support: Useable abroad with automatic currency conversion.

- Online Portal: Easy-to-navigate account dashboard.

Interest Rates and Fees

This card is a popular option in Japan. It offers various benefits tailored for residents and long-term foreign nationals.

Understanding its interest rates and fees is crucial for effective financial planning.

Annual Fee

- First Year: Free

- Subsequent Years: Free if used at least once yearly; otherwise, ¥1,375 (tax included).

Interest Rates

- Shopping (Revolving Credit): 15.00% annual interest.

- Cash Advance: 18.00% annual interest.

- Installment Payments: Typically between 13.80% to 15.00% APR, depending on the number of months selected.

Additional Fees

- Late Payment Fee: 20.00% annual interest on overdue balances.

- Foreign Currency Conversion Fee: 1.63% of each transaction made outside Japan.

Documents You’ll Need

Gather these before applying to save time.

- Photo ID: Residence Card (在留カード) or Japanese driver’s license.

- Proof of Income: Recent payslips or tax statement (if employed).

- Student Certificate: If applying as a student.

- Bank Info: Bank account number for payments.

- Phone Access: You’ll need SMS/email verification during the process.

How to Apply Online: Step-by-Step

Applying for the Life Card online is simple. Here’s how to complete it from start to finish.

Step 1: Visit the Official Life Card Website

- Go to the official Life Card application page.

- Ensure you’re on the Japanese-language site (no English version available).

Step 2: Choose Your Card Type

- Select the standard Life Card or a variant (student or co-branded versions).

- Check the details for annual fees and benefits before selecting.

Step 3: Fill Out the Application Form

Be ready to enter the following:

- Full name (in kanji and kana if applicable)

- Gender and date of birth

- Nationality and visa status

- Residential address in Japan

- Phone number and email

- Employment details and income

- Bank account details

Step 4: Submit Identification

- Upload a photo of your Residence Card or other accepted ID.

- If you’re a student, upload proof of enrollment.

Step 5: Confirm and Submit

- Double-check all information.

- Submit the form and wait for the confirmation email.

What Happens After You Apply

Once you submit your online application, here’s what to expect next.

Processing Steps:

- Email Confirmation: You’ll receive a confirmation email right after submission.

- Phone Call Verification: A staff member may call you to confirm details.

- Screening: The issuer will evaluate your credit and eligibility.

- Result Notification: You’ll get an approval or denial message within a few business days.

- Card Delivery: If approved, your card will arrive by mail within 1 to 2 weeks.

Tips to Improve Approval Chances

Getting approved for a Life Credit Card is easier when you meet the right conditions.

Follow these tips to strengthen your application and avoid common mistakes.

- Use a Japanese Mobile Number: Applications using local phone numbers are more likely to be trusted and verified.

- Enter a Valid Japanese Address: Make sure your address is accurate and matches your ID or documents.

- Apply with a Stable Income: A full-time job, part-time work, or proof of student allowance improves your reliability.

- Submit Clear, Correct Information: Avoid errors in your name, address, or employment status to prevent rejections.

- Upload Required Documents Properly: Make sure your ID, bank info, and proof of enrollment are clear and complete.

- Avoid Multiple Applications at Once: Applying for several credit cards quickly may hurt your credit review.

- Check Your Credit History: If you’ve had missed payments or past rejections, wait a few months before applying again.

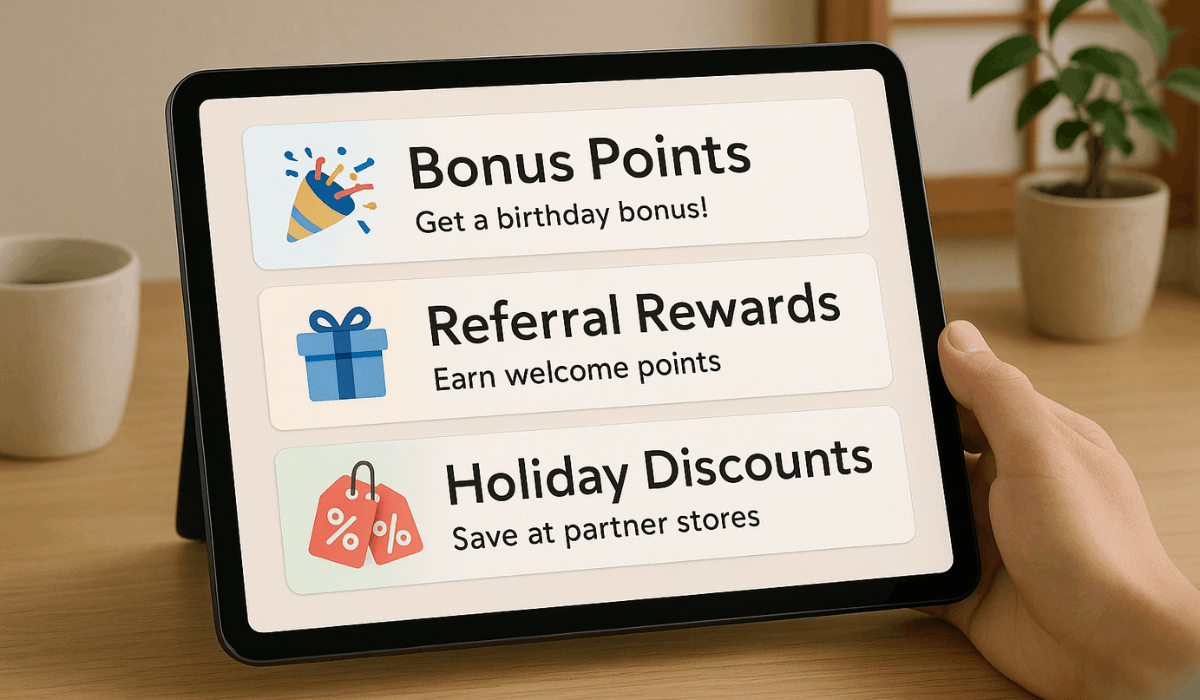

Special Campaigns and Offers

The Life Credit Card offers regular promotions to help you earn more points and enjoy extra perks. Stay updated to make the most of your card.

- Welcome Bonus Points: New cardholders may get bonus points after approval and first purchases.

- Birthday Month Bonus: Earn more points on purchases made during your birthday month.

- Seasonal Promotions: Get extra points or discounts during holidays and limited-time events.

- Referral Program: Invite friends and earn points when they’re approved.

- Partner Store Deals: Enjoy discounts or bonus points at select merchants.

- No Annual Fee for Active Users: Maintain fee-free status by using your card at least once per year.

- Utility Bill Payment Points: Earn points when you pay utility bills like electricity and water using your Life Card.

- Online Shopping Bonuses: Receive extra points or discounts when shopping at partner online retailers.

- Travel Insurance Coverage: Enjoy complimentary travel insurance when booking trips with your Life Card.

- Exclusive Event Invitations: Gain access to special events and promotions exclusive to Life Card holders.

Note: Visit the Life Card website for the latest deals and terms.

Contact Information

Need help or have questions about your application? Use the contact details below.

- Phone Support: 045-914-7003 Available weekdays from 10:00 to 17:00 (closed weekends and holidays)

- Mailing Address: Life Card Co., Ltd., 2-2-17 Takashima, Nishi-ku, Yokohama, Kanagawa 220-0011, Japan.

To Sum Up

Applying for a Life Credit Card is smooth if you prepare the right documents and meet the requirements.

With benefits like reward points, birthday perks, and overseas usability, it’s a practical choice for many Japanese residents.

Start your application on the Life Card website today and get closer to smart, flexible spending.

Disclaimer

This article is for informational purposes only.

Terms, fees, and eligibility may change—please refer to the official Life Card website for the most accurate and current details.