Looking to boost your savings quickly?

The Capital One 360 Performance Savings account offers a limited-time bonus of up to $1,500 just for meeting specific deposit requirements.

This guide will show you exactly how to qualify, open the account, and claim your reward with ease.

What Is Capital One 360 Performance Savings?

Capital One 360 Performance Savings is a no-fee, high-yield account that helps your money grow with competitive rates and FDIC protection.

Key Features

This savings account is designed to help you grow your money securely and efficiently. Here are the main features that make it a solid option:

- No monthly fees – You won’t pay maintenance or service charges.

- High interest rate – Earn a competitive APY above traditional savings accounts.

- FDIC insured – Your money is protected up to $250,000.

- No minimum balance requirement – Start saving with any amount.

- 24/7 online and mobile access – Easily manage your account through the Capital One app or website.

- Easy transfers – Link external accounts for fast deposits and withdrawals.

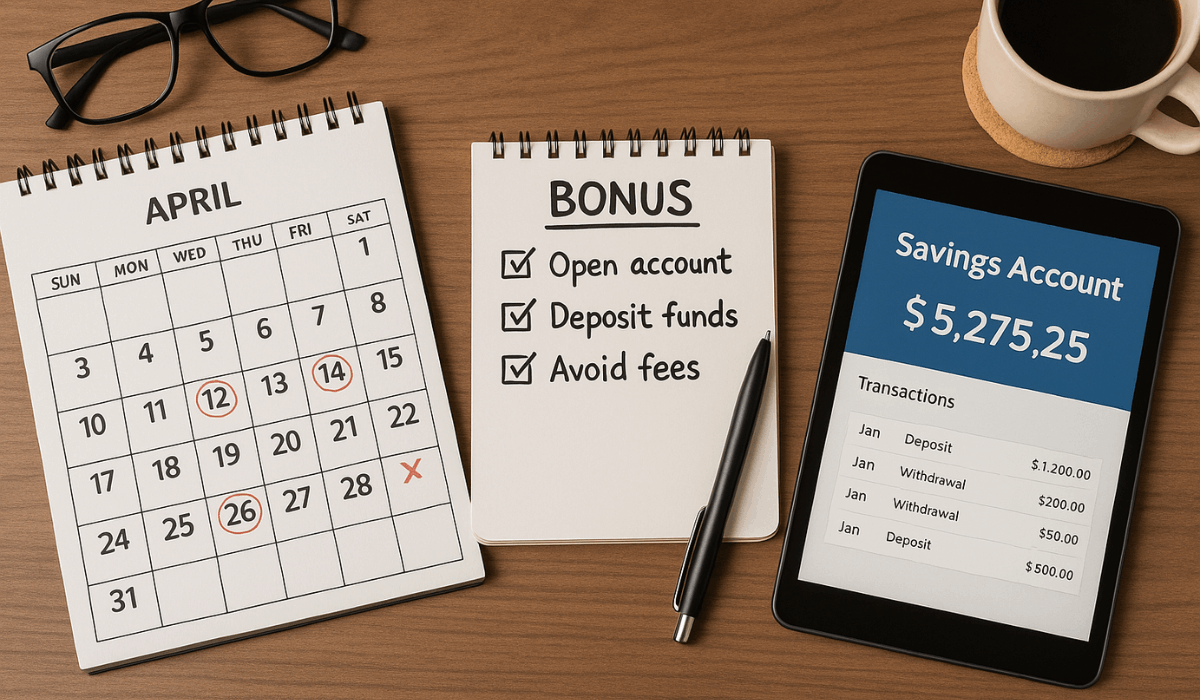

How the $1,500 Bonus Offer Works

Here’s a breakdown of how you can earn up to $1,500 by meeting deposit requirements with the Capital One 360 Performance Savings account:

- Tiered bonus structure – The reward amount increases with larger deposits, up to $1,500.

- Deposit requirement – Move money into your account within a specified window (e.g., 15 days after account opening).

- Maintain the balance – Keep the required amount in your account for a set period (typically 90 days).

- Bonus calculation – Once the holding period ends, you’ll receive the bonus based on your average balance.

- Single-time offer – You can earn the bonus only once per person or household.

Eligibility Requirements

To qualify for the bonus, make sure you meet these criteria:

- New-to-Capital One – You must be a new 360 Performance Savings customer (or follow specific change-in-status rules).

- Promo code or link usage – Open the account via the designated bonus link or enter the promo code.

- Funding window – Deposit the required minimum amount (e.g., $ 10,000 or more) within a specified timeframe (typically 15 days or less).

- Balance maintenance – Keep at least the required balance in the account for the whole holding period (usually 90 days).

- One bonus per household – Only one bonus is allowed per Social Security number or household.

Step-by-Step Guide to Open an Account

Follow these steps to open your Capital One 360 Performance Savings account and secure your bonus:

- Go to the Capital One site or app – Use the official bonus link on Capital One’s website or open the Capital One mobile app to get started.

- Select Performance Savings – Choose the 360 Performance Savings account option.

- Enter personal info – Provide your name, address, Social Security number, and other required details.

- Apply the promo code/link – Use the specific link or code tied to the bonus offer.

- Fund your account – Transfer the required minimum deposit (e.g., $ 10,000 or more) within the promotional window (typically 15 days).

- Confirm funding success – Check your account to ensure the deposit is credited and the balance meets the requirement.

Tips to Maximize Your Bonus

To ensure you qualify for the highest possible bonus, follow these smart steps.

These tips will help you stay eligible and avoid common mistakes:

- Deposit early – Fund your account as soon as possible after opening to start the 90-day holding period.

- Aim for a higher tier – Deposit enough to qualify for the $500 or $1,500 tier, if possible.

- Avoid withdrawals – Don’t move money out during the holding period, or you could lose your bonus.

- Double-check the promo code – Ensure the bonus offer is activated at sign-up, especially if using a code.

- Set reminders – Mark your calendar for the deposit deadline and balance check after 90 days.

When and How the Bonus Is Paid

After you maintain your deposit for the required holding period, here’s what happens next:

- Bonus posting timeline – Capital One typically deposits the bonus within 60 days after the 90-day holding period ends.

- Notification – You’ll receive an email or app alert confirming the bonus has been added to your account.

- Tax reporting – The bonus is treated as interest and reported on a 1099-INT form if it exceeds $10.

- Check your balance – Monitor your account to ensure the bonus appears, and contact support if it’s missing.

Pros and Cons of the Offer

Before opening the account, it’s essential to weigh the advantages and limitations. Here’s a quick comparison to help you decide:

Pros

- High bonus potential – Earn up to $1,500 just by saving.

- No monthly fees – You keep more of your money.

- Simple process – Easy online application and funding.

- Solid interest rate – Competitive APY helps your balance grow.

Cons

- High deposit requirement – Top-tier bonus requires $100,000+.

- Strict timeline – Failure to meet deadlines results in losing the bonus.

- One-time offer – No repeat bonus eligibility.

- Holding period – Funds must stay untouched for 90 days.

Is It Worth It?

If you’re considering this offer, think about your financial goals and cash flow. Here are key points to help you decide:

- You have idle savings – If you’re holding a large balance in a low-yield account, this bonus can add real value.

- You don’t need the funds in the short term – The 90-day hold means this isn’t ideal for emergency cash.

- You want a risk-free return – The bonus plus interest is guaranteed if you follow all terms.

- You’re new to Capital One – Existing customers may not qualify, so check your status.

- You’re organized with deadlines – You must meet specific timelines to avoid losing the bonus.

Common Mistakes That Can Void the Bonus

Missing even one step can disqualify you from receiving the bonus. Watch out for these common errors:

- Not using the promo link or code – If you skip this, the bonus won’t be applied.

- Funding too late – You must deposit the required amount within the set window (usually 15 days).

- Dropping below the required balance – Withdrawing money during the 90 days can void eligibility.

- Opening the wrong account type – Only the 360 Performance Savings account qualifies.

- Already having a 360 Savings account – Existing or recent customers may be ineligible.

- Opening multiple accounts – Only one bonus is allowed per person or household.

Alternatives to Capital One’s Bonus Offer

If you don’t meet the requirements or want to compare other options, several banks offer similar promotions.

Here are some alternatives worth checking:

- Discover Online Savings – Offers a cash bonus (usually $150–$200) for meeting deposit thresholds.

- SoFi Checking & Savings – Earns up to $300 with qualifying direct deposits.

- Citi® Savings Account – Offers tiered cash bonuses, sometimes up to $2,000 for huge deposits.

- Chase Savings – Often offers limited-time $200 bonus promotions with simple funding requirements.

- PNC Virtual Wallet – Offers tiered bonuses on combined checking and savings products.

Each option has different deposit requirements, deadlines, and eligibility rules—so compare carefully before deciding.

The Bottomline

The Capital One 360 Performance Savings bonus is a strong opportunity if you can meet the deposit and timeline requirements.

With up to $1,500 on the table, it’s a smart move for anyone with savings to park.

Open your account today through the official bonus link and start working toward your reward.

Disclaimer

Promotional offers, bonus amounts, and eligibility requirements are subject to change at Capital One’s discretion.

Always review the latest terms and conditions on the official Capital One website before submitting your application.