Personal loans are often used to consolidate debt, cover medical expenses, or improve your home. Choosing the right lender can help you save money and reduce financial stress.

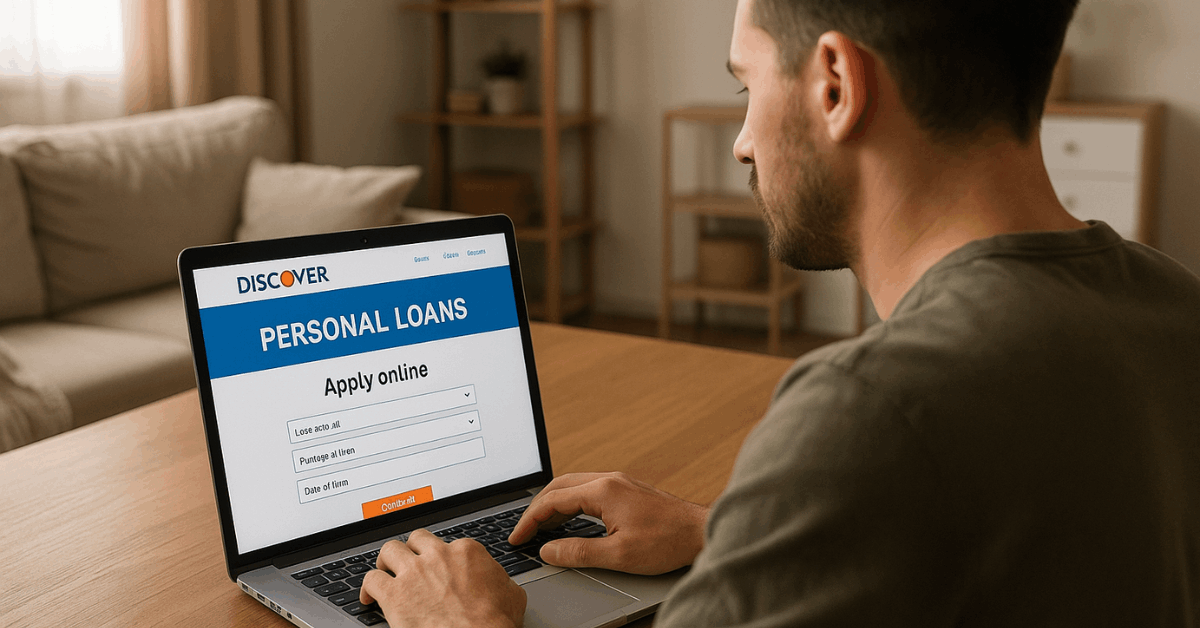

Discover Personal Loans is one of the well-known options in the U.S. market. This article compares Discover with other lenders to give you a clear understanding of how they stack up.

Understanding Personal Loans

Personal loans are unsecured loans, meaning no collateral is required. They provide flexibility in how you use the funds.

Many borrowers take them to cover unexpected expenses or to pay down high-interest credit card balances. Others use them for large projects like remodeling their homes.

What is a Personal Loan?

A personal loan gives you a lump sum of money that you repay over a set period with interest. Unlike mortgages or auto loans, you can use it for almost any purpose.

This freedom makes them attractive to many borrowers. Still, approval depends on income and credit history.

How Personal Loans Work?

When you apply, lenders check your credit and income. Once approved, funds are sent directly to your bank account or creditors.

Payments are fixed each month, making it easier to budget. Interest rates vary based on your profile and the lender’s policies.

Discover Personal Loans Overview

Discover offers competitive personal loan products that attract borrowers. Its focus is on transparency and speed.

With fixed APR and no fees, it provides certainty to customers. Many appreciate the simplicity of its lending process.

Key Features

Discover personal loans come with loan amounts between $2,500 and $40,000. APR ranges from 7.99% to 24.99% with fixed rates.

Terms can stretch from three to seven years. Importantly, there are no origination fees or prepayment penalties.

Eligibility Requirements

To qualify, you must have a valid U.S. Social Security number. You need to be at least 18 years old and earn $25,000 or more annually.

Applicants must also provide a physical address and an active email. A stable income and good credit history improve approval chances.

Comparing Discover to Other Lenders

Choosing a personal loan means comparing across multiple lenders. Each offers different rates, terms, and benefits.

Discover stands out for its no-fee structure and reliable funding speed. However, other lenders may offer features that suit different borrower needs.

Interest Rates and APR

- Discover: 7.99%–24.99% APR.

- Citibank: 8.99%–19.49% APR.

- LendingClub: 7.9%–35.99% APR.

- SoFi: 8.99%–35.49% APR.

Discover is competitive at the lower end of APR ranges, making it strong for borrowers with good credit.

While LendingClub and SoFi extend higher, their max APRs are less favorable. Citibank, however, has a lower cap but lacks Discover’s no-fee promise.

Loan Terms and Flexibility

Discover allows repayment terms from three to seven years. Many lenders cap terms at five years, limiting flexibility.

Longer terms can lower your monthly payments but increase total interest costs. Borrowers must weigh affordability against long-term expense.

Fees and Costs

Discover charges no fees, which is a key advantage. LendingClub and others deduct origination fees from your loan amount.

Prepayment penalties can also appear with smaller lenders. With Discover, you keep more of your borrowed funds.

Loan Amounts Offered

Discover provides loans up to $40,000. SoFi offers as much as $100,000, which benefits borrowers needing larger financing.

Citibank and LendingClub fall somewhere in between. Discover’s mid-range ceiling is suitable for most household needs.

Funding Speed

Funding speed matters if you face urgent expenses. Discover can disburse money as early as the next business day after approval.

Peer-to-peer platforms like LendingClub often take longer due to investor matching. Quick access makes Discover reliable for emergencies.

Benefits of Choosing Discover

Borrowers often select Discover for its simplicity and clarity. It’s a straightforward process that appeals to people who want to avoid hidden costs. Transparency is a major advantage when comparing lenders.

Transparency

Discover’s personal loans have no origination or prepayment fees. This eliminates surprise costs during repayment.

You know exactly how much you owe and when. For many, this clarity makes Discover attractive.

Customer Support

Discover provides 24/7 customer service by phone. You can also manage your account online.

This ensures you always have access to help when needed. Support is consistent, which improves borrower satisfaction.

Reliability and Trust

As a well-known U.S. financial company, Discover has built trust over decades. Its reputation gives borrowers confidence.

Choosing a reputable institution can reduce the risk of issues. This reliability is one of Discover’s strongest features.

When Other Lenders May Be a Better Fit?

Discover is not always the best option for every borrower. Depending on your needs, other lenders may be more appropriate. Comparing carefully ensures you make the best financial decision.

Larger Loan Amounts

SoFi is a better choice if you need more than $40,000. It can provide up to $100,000 in personal loans.

This makes it useful for major investments or projects. Discover may be too limited for such cases.

Narrower APR Ranges

Citibank offers APRs capped at 19.49%, lower than Discover’s maximum. Borrowers with strong credit might find this beneficial.

The trade-off is that Citibank may include fees Discover avoids. This means you should calculate both rates and costs.

Special Perks

Some lenders add unique benefits. SoFi includes unemployment protection and member discounts.

LendingClub may offer peer-to-peer borrowing flexibility. If these features matter to you, Discover may not cover them.

Step-By-Step: How to Apply for a Discover Personal Loan

Applying for a loan involves a few clear steps. Discover keeps the process digital and straightforward.

You can complete everything online with little hassle. Approval depends on accurate and complete information.

Online Application

Start by visiting Discover’s website and filling in personal details. You must provide your Social Security number, income, and contact information.

A soft credit check will show you potential rates without affecting your score. Accuracy at this stage helps speed approval.

Offer Review

Once Discover reviews your details, you receive loan options. You can compare interest rates, loan amounts, and repayment terms.

Choosing the best fit is critical for long-term affordability. After selecting, you move to final approval.

Approval and Funding

After accepting an offer, Discover performs a hard credit check. If successful, your loan is finalized.

Funds are often sent to your account the next business day. Fast processing is one of Discover’s key strengths.

Interest Rates and Important Disclaimers

Interest rates and disclaimers are critical for borrowers to understand. Terms can vary widely, and rates depend heavily on credit history. Always check the most current information from the lender.

Interest Rate Details

Discover offers fixed APR between 7.99% and 24.99%. Rates depend on income and repayment term.

Larger loans and longer terms may increase costs. Borrowers should weigh both monthly payments and total interest.

Disclaimer

Rates and eligibility requirements can change. Approval is not guaranteed even if you meet basic criteria.

All loan decisions depend on Discover’s final review. Always confirm details directly on the official website.

Discover Contact Information

Borrowers should know how to contact Discover for loan questions. Reliable communication ensures smooth handling of issues. Here are the main details.

- Phone: 1-866-248-1255 (Personal Loans).

- Mailing Address: Discover Personal Loans, P.O. Box 30954, Salt Lake City, UT 84130-0954.

- Website

Conclusion: Choosing the Right Loan Option

Discover Personal Loans offers clear terms, no fees, and fast funding. Compared to other lenders, it stands out for its transparency and reliability.

Still, lenders like SoFi and Citibank may be better for larger loans or narrower APR caps. Ultimately, the best choice depends on your financial needs and long-term goals.