The Consors Finanz Mastercard is a flexible credit card designed for shoppers in Germany, offering zero annual fees and quick PoS (Point-of-Sale) financing.

You can apply directly in partner stores or online, with fast approval and full digital management.

This guide will show you how to apply, what to prepare, and what to expect after approval.

What is the Consors Finanz Mastercard?

The Consors Finanz Mastercard is a fee-free credit card that offers revolving credit and installment payment options for purchases made at point-of-sale (PoS) locations in Germany and worldwide.

It includes digital management via app, contactless payments, and optional insurance add-ons.

Key Benefits

The card gives you more control and flexibility over your shopping and spending—right from your pocket.

- No annual fee – keeps your costs low every year.

- Flexible repayment – choose to pay in full or spread out payments with installed plans.

- App-based management – track spending, set limits, and lock your card easily.

- Contactless & virtual payments – fast and secure payments in stores and online.

- Worldwide acceptance – use it at any Mastercard outlet globally.

- Optional insurance perks – like purchase protection or travel-related coverage.

Eligibility Criteria

To apply, you must meet the basic requirements set for consumers in Germany. These ensure you’re eligible for credit approval and account setup.

- At least 18 years old

- Permanent residence in Germany

- Valid SEPA-compatible German bank account

- Proof of regular income (e.g., employment, pension)

- Valid government-issued ID (Personalausweis or passport + residence registration)

Required Documents

Before applying, ensure you have the necessary documents ready. These are required to verify your identity and assess your financial standing.

- Valid ID – German ID card or passport with proof of address

- Proof of income – recent payslips or income tax statement

- Bank details – IBAN from your German bank account

- Proof of residence – registration certificate if not shown on ID

Step-by-Step Application Process

You can apply easily either online or directly at participating partner stores in Germany. Here’s a step-by-step look at how the process works from start to finish.

- Choose your method – apply online via the official website or in-store at a partner retailer.

- Fill out the application form – enter personal, financial, and contact details.

- Select repayment option – choose between full payment or monthly installments.

- Complete identity verification – use VideoIdent or PostIdent to confirm your identity.

- Wait for approval – most applications are reviewed within 1–2 business days.

- Receive your card – if approved, your card will be sent by post and is ready for activation.

What to Expect After Applying

Once you submit your application, a few quick steps follow before you can start using your card. Here’s what typically happens after applying.

- Credit check review – your Schufa score and financial history are evaluated.

- Approval notice – you’ll get a confirmation by email or SMS within 1–2 business days.

- Card delivery – the physical card is delivered by post, typically within 5–7 business days.

- Activation process – follow the instructions to activate your card online or via the app.

- App setup – download the mobile app to manage your card and transactions.

- Start using your card – make purchases online or in-store once it’s activated.

Managing Your Card

Once your card is active, managing it is simple with the mobile app and online tools.

You can track spending, set payment preferences, and stay in control at all times.

- Track your balance – view your available credit and transaction history at any time.

- Set up repayment plans – choose between full payment or flexible monthly installments.

- Lock and unlock your card – instantly disable or re-enable the card through the app.

- Customize alerts – get notifications for purchases, payments, or unusual activity.

- Update personal details – change your contact or banking info directly in the app.

- Contact support – reach out to customer service through the app or hotline if needed.

Fees and Interest

It’s essential to understand the potential costs associated with using your card.

While there’s no annual fee, interest and service charges may apply depending on how you use it.

- Annual fee – €0 (permanent)

- Standard APR for revolving credit – approx. 14.90% to 16.90% (variable)

- Cash withdrawal fee – 3.95%, minimum €5 per transaction

- Foreign currency transaction fee – 1.75% of the amount converted

- Late payment fee – may apply if minimum payment is missed

- Installment interest – based on plan; fixed for each purchase agreement

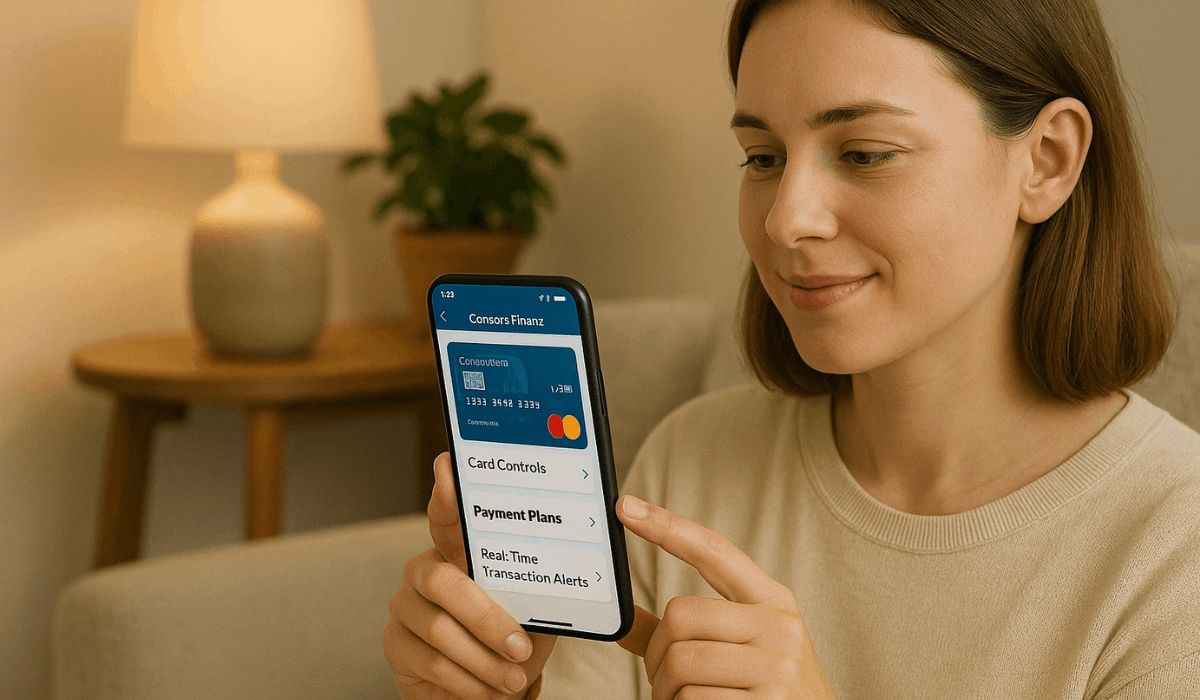

Mobile App Features

The mobile app gives you complete control over your card, allowing you to manage your account easily at any time.

It includes essential tools for tracking, adjusting settings, and staying secure.

- Real-time transaction tracking – view your purchases and remaining credit instantly.

- Card control – activate, block, or unblock your card with one tap.

- Flexible payment setup – switch between payment types or set installment plans.

- Document access – download account statements and financing agreements.

- Biometric login – sign in securely using fingerprint or facial recognition.

- Push notifications – get alerts for every transaction or system update.

Security Features

Security is a crucial aspect of using your card with confidence. The system includes tools that protect your transactions and provide you with control in the event of suspicious activity.

- Two-factor authentication (2FA) – confirms online purchases with added verification.

- Instant Card Lock – Temporarily block your card through the app if it’s lost or stolen.

- Real-time alerts – get notifications for each transaction or login attempt.

- Spending controls – set limits or restrict card use to specific regions or channels.

- Fraud monitoring – suspicious activity is flagged and may trigger security checks.

- PIN management – change your PIN securely using the mobile app.

Customer Support and Contact Information

If you have questions or run into issues, customer support is available through multiple channels. Here’s how you can get help or reach the service team.

- Customer hotline (Germany): 0203 34695301 (Mon–Sat, local rates apply)

- Email support: Use the contact form on the official Consors Finanz website

- Mailing address: Consors Finanz BNP Paribas, Schwanthalerstr. 31, 80336 München, Germany

- In-app support: Chat and service requests are available via the mobile app

- Online FAQ: Access detailed help topics on their official support page

- Language options: Support available in German; limited English support may apply

The Bottomline

The Consors Finanz Mastercard offers flexible payment options, no annual fees, and easy management through a secure mobile app.

It’s a practical choice for everyday use and big purchases across Germany.

If you’re ready to apply, visit the official website or ask at a partner store to get started today.

Disclaimer

The details in this article are subject to change over time.

Always refer to the official Consors Finanz website for the latest application terms, features, and conditions.