Citibank Personal Loan provides a clear way to consolidate high-interest card balances into one fixed-rate installment, lowering interest while giving a defined payoff date and simpler cash flow.

Provided income is stable and the loan amount fits your budget, you replace multiple due dates and variable rates with predictable payments aligned to a repayment plan.

Review APR, fees, and eligibility in your market, confirm the new installment stays affordable, and resolve any past-due accounts prior to applying.

When Debt Consolidation Makes Sense

High-interest balances spread across cards and lines make progress feel slow. Consolidation replaces multiple payments with one fixed-term loan, helping you lower interest, gain a payoff date, and simplify cash flow.

Signs Consolidation Helps

Carrying revolving balances at double-digit rates, juggling more than two due dates monthly, or struggling to reduce principal despite making payments are common triggers.

A fixed-rate personal loan can convert variable card interest into predictable installments that end on a specific date.

When to Avoid Consolidation

Active late payments, unstable income, or total debt that would still exceed an affordable monthly payment after consolidation suggest pausing.

Fix cash leaks first, build a small emergency buffer, then use consolidation once repayment capacity is stable.

Citibank Options for Consolidation

Picking the wrong tool creates new fees without solving the rate problem. Use this quick side-by-side to match a Citi option to your situation.

| Citi option | Best for | Typical cost/fees* | Limit basis | Repayment style | Notable caveat |

| Citi Personal Loan | Replacing several card balances at a fixed rate | Competitive APRs; no annual fee mentioned | Credit profile and income | Fixed term, equal monthly payments | Prepayment, origination, and other fees vary by market |

| Balance Transfer (to Citi Credit Card or Ready Credit) | Short runway to clear debt at low promotional rate | Markets like Singapore offer 0% p.a. for 6 months with ~1.58% service fee for eligible new accounts | Card/line limit and policy | Promo rate period, then reverts to standard rate | Requires clearing balance before promo ends |

| Ready Credit (line of credit) | Temporary liquidity and staged payoff | Interest accrues on used amount only | Credit profile and income | Revolving; can pay in installments | Discipline needed to avoid re-borrowing |

| Citi PayLite | Converting recent card purchases into installments | Low processing fees; tenure up to 36 months | Card limit | Fixed installments on converted spend | Applies to eligible unbilled transactions, not old balances |

| Citi FlexiBill | Splitting statement balance into installments | Instant conversion via app | Card/line and eligibility | Fixed installments on billed balance | Fees and rates vary; not all charges eligible |

Features vary by country and product. Examples shown include Citi Singapore references.

Eligibility and Cost Factors to Check

Strong approval odds and a low total cost start with a quick diagnostic.

Credit Profile

Higher scores expand lender options and typically reduce APR. Pull free credit reports to verify accuracy, then address errors and recent delinquencies before applying.

Income and Loan Size

Stable income supports a realistic consolidation amount. Right-sizing the loan to cover target balances while keeping the monthly payment inside budget prevents new shortfalls.

APR and Total Cost

Fixed APR, repayment term, and any origination or service fees determine the all-in cost. Shorter terms raise monthly payments yet reduce interest paid; longer terms ease cash flow while increasing total interest.

Fees and Early Repayment

Markets differ on prepayment, processing, and transfer fees. Reading fee schedules and asking about early-settlement rules avoids surprises if an opportunity to pay off early appears.

How to Apply for a Citi Personal Loan

Fast processing helps only when inputs are complete and accurate. Follow these steps to move cleanly from quote to funding.

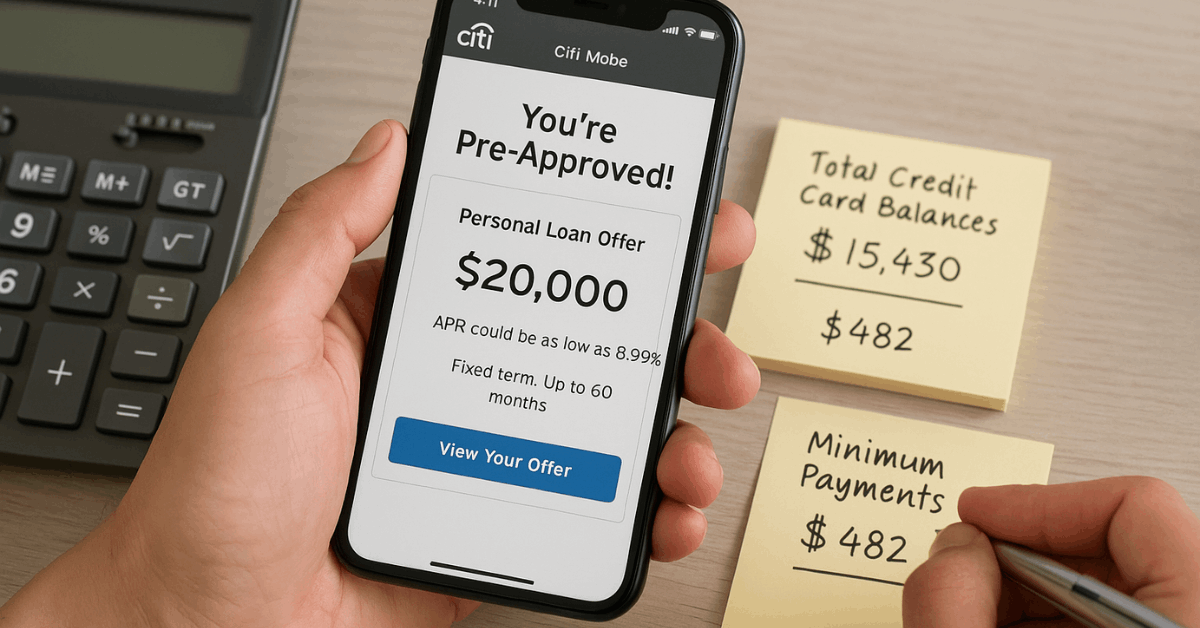

- Set the target amount and payment fit: List balances, rates, and minimums, then size the loan to clear high-rate accounts while keeping the new installment affordable alongside essentials and savings.

- Review credit and fix issues: Request credit reports, correct errors, and reduce utilization where possible to qualify for better terms and broader product choices.

- Compare Citi options and alternatives: Check personal loan APRs against available balance-transfer promotions and lines of credit, choosing the option that yields the lowest total cost within your payoff horizon.

- Gather documents: Prepare ID, address proof, and income proofs such as recent pay statements, W-2s, or tax returns; benefit letters such as Social Security or SSI may also apply.

- Submit and receive funds if approved: Applications can be completed online, by phone, or in person where available. Some Citi applications generate a decision in under sixty seconds, then proceed to disbursement.

Funding Speed and Payout Choices

Eligible Citi customers can receive funds the same business day when depositing directly to a Citi account.

Direct deposit to a non-Citi account typically arrives within two business days, while a check by mail usually takes about five business days. Timelines depend on verification, bank cut-offs, and local processing rules.

Required Documents

Missing proofs cause delays and repeated requests. Keep the following ready to accelerate approval.

- Application details covering legal name, contact information, date of birth, and taxpayer ID or Social Security number.

- Government-issued ID such as passport, driver’s license, or voter ID card.

- Proof of address via ID, utility bill, lease agreement, or similar acceptable document.

- Proof of income including current pay statement, recent W-2s, and tax returns; benefit letters such as Social Security or Supplemental Security Income can support eligibility where applicable.

Using the Loan to Eliminate Debt Efficiently

Structured execution turns a consolidation loan into lasting relief.

Close the Loop On High-Rate Accounts

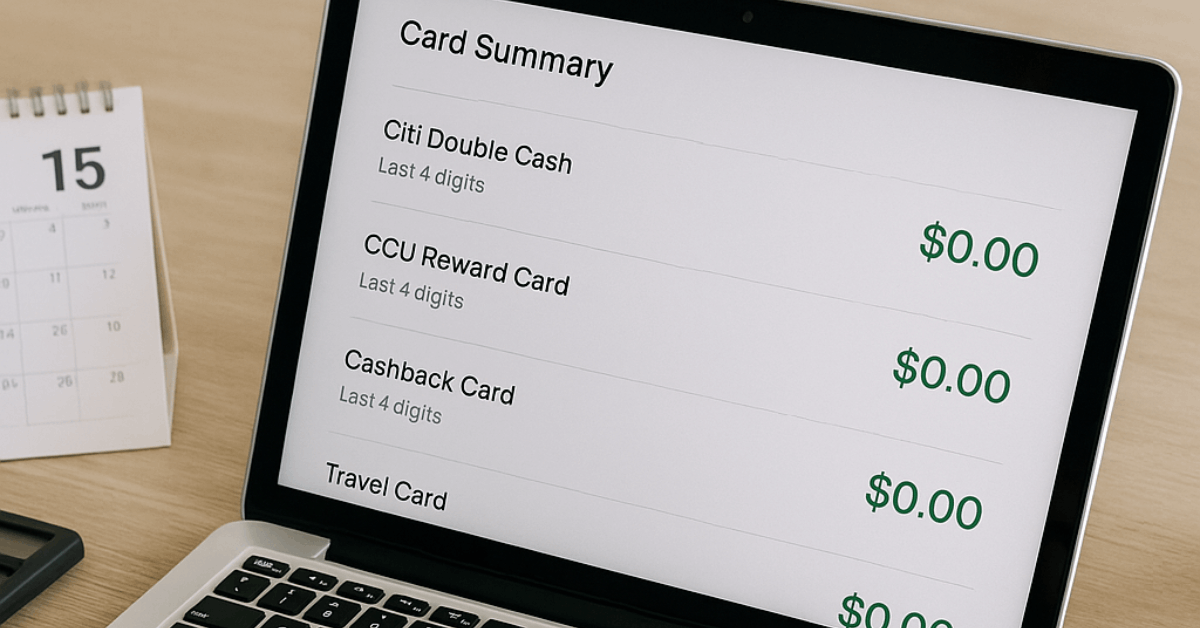

Once funds arrive, pay target balances in full and confirm zero balances online. Prevent new spending on those accounts until the consolidation installment is established without strain.

Automate and Monitor

Auto-debit the new installment on payday to reduce missed-payment risk. Tracking balances and monthly reports helps confirm the decline in total debt and preserves credit score momentum.

Prevent Re-Accumulation

A written spending plan and a modest emergency buffer reduce the odds of running balances back up. Retaining one low-rate, no-fee card for essential recurring bills may preserve credit history while containing temptation.

Quick Rules: Balance Transfer vs. Personal Loan

Decision speed matters when promotions are short. Apply these rules when picking between a transfer and a fixed-term loan.

- Choose a balance transfer when a realistic plan clears the balance within the promotional period and the service fee remains lower than expected loan interest.

- Pick a personal loan when a longer payoff is needed, a single fixed rate offers clarity, and the total cost beats promo-then-revert card math.

- Use Ready Credit for short-term liquidity needs that can be repaid quickly, keeping interest limited to the amount used.

- Select PayLite or FlexiBill when installment control is needed on recent purchases or a current statement, rather than consolidating old debt across multiple issuers.

- Re-run numbers if income or rates change, ensuring the originally chosen option still wins on total cost.

Consolidation Plan in Practice

Consider a household carrying three card balances at high variable rates while paying only slightly above the minimums. A Citi personal loan sized to cover those balances could replace three due dates with one predictable installment at a lower fixed APR.

After funding, immediate payoffs would be executed to zero out the cards, auto-debit would be set for the new loan, and discretionary spending would be throttled until the first three on-time payments post.

A small emergency buffer would be built next, followed by optional early principal payments if cash flow allows, accelerating the payoff without violating any prepayment rules.

Conclusion

Citibank lends to eligible new and existing customers subject to credit, income, and other criteria determined by the bank.

Product names, limits, rates, fees, and promotions differ by country; examples referenced include Citi Singapore features such as Quick Cash limits and a six-month 0% p.a. balance transfer offer carrying a service fee for eligible accounts.

Educational guidance in this article does not constitute legal, investment, or financial advice and does not indicate product availability. Personal circumstances vary, so consulting a qualified professional and reviewing official product pages before applying remains essential.