The Bank of America cards are commonly used for travel and dining expenses. Many readers want to know how the Bank of America Premium Rewards application works and what steps are required.

Understanding eligibility and requirements helps you prepare before applying. This article covers key features, the application process, and important disclaimers.

Understanding the Premium Rewards Card

The Premium Rewards Card is designed for those who travel and dine frequently. It provides higher points on select purchases and a strong welcome bonus.

To apply successfully, you should first understand its benefits and structure. Knowing the key features will also help you compare it with other credit card options.

Main Benefits of the Card

This card provides strong earning power on everyday purchases. You will earn 2 points per $1 on travel and dining and 1.5 points per $1 on all other spending.

Points can be redeemed for cash back, travel, or statement credits. A 60,000-point bonus is offered after meeting initial spending requirements. The card also offers $200 in airline and TSA credits, plus no foreign transaction fees.

Fees and Rates to Know

The annual fee is set at $95, which is lower than many premium competitors. Standard purchases have a variable APR ranging from 20.24% to 28.24%.

Balance transfers include an intro 3% fee for the first 60 days, then increase to 4%. There are no hidden foreign transaction charges. These costs make the card manageable if you pay balances on time.

Eligibility and Requirements

Before beginning the application process, it is important to confirm you meet Bank of America’s criteria. Requirements focus on identity verification, credit standing, and financial stability.

Having the necessary documents ready makes the process easier. Meeting these conditions increases your approval odds.

Documents and Personal Information Needed

When applying, you must provide legal name, date of birth, Social Security number or ITIN, and gross annual income. A U.S. residential address is required, along with your citizenship or residency details.

Employment information may be verified to confirm income stability. Having updated details ensures a smooth submission. Bank of America follows federal law by requesting this identification.

Recommended Credit Profile

Applicants typically need a good to excellent credit score (700+ FICO). A strong history of on-time payments and limited debt helps with approval.

Stable employment or proof of steady income is also considered. If your credit is below recommended levels, it may be harder to qualify. Preparing your credit report before applying is highly encouraged.

Step-By-Step Application Process

The application process can be completed online, by phone, or at a branch. Each method requires the same personal and financial information. Submitting online is the fastest and most common option. Below is a breakdown of the steps.

Applying Online

Here are the steps you will follow to complete your online application. This outline makes the process clear and direct.

- Begin by selecting the Premium Rewards Card on the Bank of America website.

- Click Apply Now to start the secure form.

- Enter your personal details, such as name and birth date.

- Provide your contact information, including address, phone number, and email.

- Input employment and income data, along with citizenship status.

- Review terms carefully before submitting your application.

Applying by Phone or In Person

If you prefer, you can apply by calling 800.932.2775 and giving the priority code HC022T if available. The representative will ask for the same information required online.

You can also apply in person at a Bank of America financial center. This option works well if you need assistance or have additional questions.

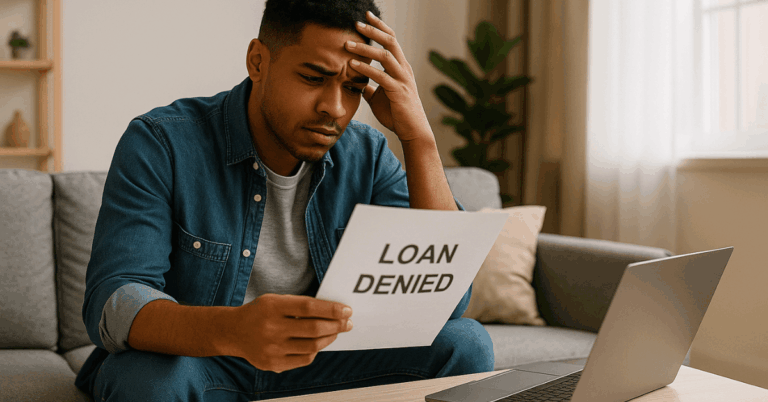

What Happens After You Apply?

Once your application is submitted, Bank of America runs a credit check. This is considered a hard inquiry, which may slightly impact your score.

Approval decisions are often given instantly, though some require more time. The bank may request further documentation if needed.

Approval and Card Delivery

If approved, you’ll receive your card within 7–10 business days. Some applicants may qualify for expedited shipping. Once received, activate your card online or by phone.

You can then begin earning rewards immediately. If denied, you will get a letter explaining the reasons.

Preferred Rewards Benefits

Bank of America offers a loyalty program called Preferred Rewards. This program allows members to boost their rewards earnings.

If you hold qualifying deposit accounts with the bank, you can receive between 25% and 75% more points. Enrolling can significantly increase the value of your Premium Rewards Card.

How It Works?

The program is divided into tiers based on average account balances. Higher balances qualify for higher bonus percentages.

For example, Gold level provides 25% more points, Platinum offers 50%, and Platinum Honors offers 75%. These boosts apply to every purchase you make. This can turn 2 points per $1 into as much as 3.5 points per $1.

Interest Rates and Fees

Every credit card has important terms that applicants must understand. The Premium Rewards Card is no exception.

Reviewing disclosures ensures there are no surprises later. The purchase APR ranges from 20.24% to 28.24% variable, depending on creditworthiness.

Intro balance transfers are 3% for the first 60 days, then 4%. Carrying a balance means paying interest at the stated APR. Paying balances in full avoids these charges.

Key Disclosures

Points never expire as long as your account is open. Rewards offers and benefits may change without notice. Annual fees are charged whether or not you use the card actively.

Bank of America reserves the right to decline applications if requirements are not met. Reviewing the Terms and Conditions during application is critical.

Tips for Approval

To improve your approval chances, take a few steps before applying. Managing your credit report is the first priority.

Providing accurate and consistent information is also important. Following these steps avoids delays or rejections.

Preparing Before Applying

These steps make you a stronger candidate for approval.

- Check your credit report for errors and resolve issues in advance.

- Pay down existing debts to lower your credit utilization.

- Gather required documents such as proof of income and identification.

- Avoid multiple recent applications, as they can reduce approval odds.

Customer Support and Contact Details

If you have questions, Bank of America provides multiple support options. Assistance is available online, by phone, or in person.

Using the right contact method depends on your situation. Having the official details ensures you can reach help quickly.

How to Reach Bank of America?

These options provide quick access to reliable assistance.

- Phone: Call 800.932.2775 for credit card inquiries.

- Website: Visit www.bankofamerica.com/credit-cards for applications and FAQs.

- In person: Go to any Bank of America financial center for direct support.

Conclusion: Applying With Confidence

The Bank of America Premium Rewards Card is a strong choice for travelers and diners seeking valuable rewards. The application process is simple, whether done online, by phone, or at a branch.

By preparing your documents and credit profile in advance, you can improve approval chances. With clear terms, powerful rewards, and flexible benefits, applying for this card can be a smart financial step.

Disclaimer: All information provided is subject to change. Always review Bank of America’s official terms before applying.