The Amazon Credit Card gives you rewards and cashback on every purchase, with extra perks for Prime members.

Applying online is quick and straightforward, letting you start earning benefits immediately. This guide will show you exactly how to apply, what fees and interest rates to expect, and how to make the most of your card.

What is the Amazon Credit Card?

The Amazon Credit Card is a payment card that offers cashback and rewards on Amazon purchases and select categories.

It comes in two main types: the Prime version for Amazon Prime members and the Standard version for non-Prime users.

Types of Cards:

- Amazon Prime Rewards Visa Card – Available only to Amazon Prime members, offers higher cashback on Amazon.com and Whole Foods purchases.

- Amazon Rewards Visa Card (Standard) – Available to non-Prime users, offers cashback on Amazon purchases, restaurants, gas stations, and drugstores.

Key Features:

- Cashback on Amazon.com purchases (higher for Prime members).

- Rewards at restaurants, gas stations, and drugstores.

- No foreign transaction fees.

- Sign-up bonus for new cardholders.

- Integration with an Amazon account for easy payment and rewards tracking.

- Fraud protection and account alerts.

Rewards:

- Amazon.com purchases: 5% cashback with Prime, 3% without Prime.

- Whole Foods Market purchases: 5% cashback with Prime, 3% without Prime.

- Restaurants, gas stations, drugstores: 2% cashback.

- All other purchases: 1% cashback.

- Sign-up bonus: Varies by promotion, typically a one-time Amazon gift card.

- No expiration: Rewards points do not expire as long as the account is active.

Eligibility Requirements

To apply for the Amazon Credit Card, you must meet specific eligibility requirements. Knowing these beforehand helps you avoid application rejection and speeds up the approval process.

- Age: Must be at least 18 years old (19 in some states).

- Residency: Must be a U.S. resident with a valid address.

- Credit History: Generally requires a good to excellent credit score.

- Income: Must have a steady source of income to support payments.

- Identification: Valid Social Security number and government-issued ID.

- Amazon Account: Must have an active Amazon account.

Documents and Information Needed

Before starting the online application, gather all necessary personal and financial information. Having these ready ensures a smooth and quick submission process.

- Government-issued ID (driver’s license, passport, or state ID).

- Social Security number.

- Current residential address and contact information.

- Employment details and annual income.

- Bank account information for payments.

- Existing credit card information (if applicable).

- Email address and phone number for communication.

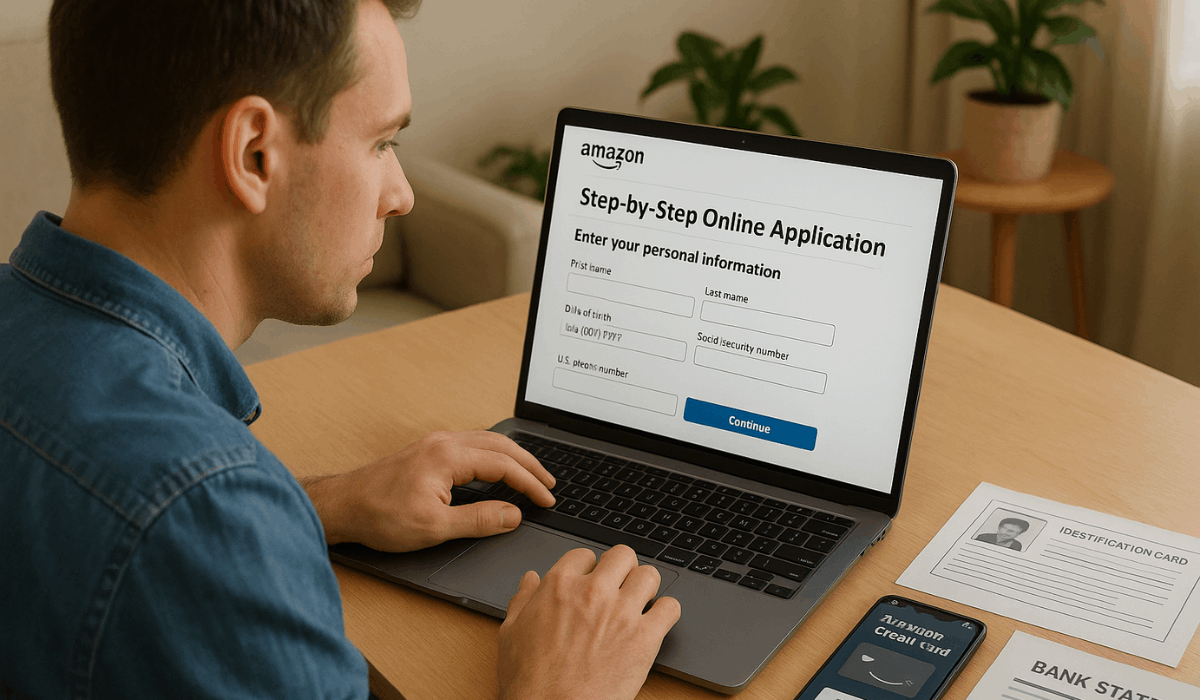

Step-by-Step Online Application

Applying for the Amazon Credit Card online is fast and can be completed in just a few minutes if you have your information ready. Follow these steps carefully to submit your Amazon Credit Card application successfully.

- Visit the official Amazon Credit Card page – Access the Amazon Credit Card application on the card issuer’s website.

- Sign in or create an Amazon account – Use your existing Amazon account or register a new one if needed.

- Enter personal details – Fill in your full name, address, date of birth, and Social Security number.

- Provide financial information – Include employment details, annual income, and any existing credit accounts.

- Select the card type – Choose between the Amazon Prime Rewards Visa Card or the Amazon Rewards Visa Card.

- Review terms and conditions – Confirm APR, fees, and rewards details before submitting.

- Submit the application – Ensure all information is accurate, and submit your Amazon Credit Card application.

- Wait for approval – Approval may be instant, or additional verification could be required.

Interest Rates and Fees

Knowing the interest rates and fees is crucial before applying for the Amazon Credit Card.

These details affect your monthly payments and overall cost if balances are carried over.

- Purchase APR: 17.24%–26.24% variable, based on creditworthiness

- Balance Transfer APR: 17.24%–26.24% variable

- Cash Advance APR: 26.24% variable

- Annual Fee: $0 for both Prime and Standard versions

- Late Payment Fee: Up to $41

- Returned Payment Fee: Up to $41

- Foreign Transaction Fee: $0

Approval Process & Timeline

Understanding the approval process and timeline helps you know what to expect after submitting your Amazon Credit Card application.

This ensures you are prepared for verification steps and the potential waiting period.

- Instant Decision: Many applicants receive an instant approval decision online.

- Additional Review: Some applications may require extra verification, such as providing proof of income or identity.

- Notification: You will be notified via email or your Amazon account once the decision is made.

- Card Delivery: If approved, the physical card typically arrives within 7–10 business days.

- Activation: Activate the card immediately online or via phone to start using it.

Managing Your Card Online

Managing your Amazon Credit Card online gives you full control over payments, rewards, and account settings.

Using the online portal or app makes it easy to track spending and stay organized.

- Check Balance: View your current balance and available credit at any time.

- Make Payments: Pay your bill online, set up automatic payments, or schedule future payments.

- Track Rewards: Monitor cashback and reward points earned from purchases.

- View Statements: Access and download monthly statements for record-keeping.

- Set Alerts: Receive notifications for due dates, payment confirmations, and suspicious activity.

- Update Information: Change personal details, contact info, or payment methods securely.

Tips to Maximize Benefits

Maximizing your card benefits helps you get the most rewards and savings from every purchase.

Following these tips ensures you use the card efficiently while avoiding unnecessary fees.

- Use for Amazon Purchases: Always pay with the card on Amazon.com to earn the highest cashback.

- Take Advantage of Prime Benefits: Prime members earn higher rewards on Amazon and Whole Foods purchases.

- Pay on Time: Avoid interest charges and late fees by paying the full balance each month.

- Combine with Promotions: Use seasonal Amazon promotions or special offers to increase rewards.

- Track Rewards Regularly: Monitor earned points to redeem them effectively for purchases.

- Use for Everyday Spending: Earn cashback on gas, restaurants, and drugstores.

- Avoid Carrying a Balance: Minimize interest payments by paying off purchases quickly.

Contact Information

Having the correct contact information for the Amazon Credit Card issuer is essential for support, billing questions, or reporting a lost or stolen card.

Keep it handy to resolve any issues efficiently.

- Customer Service Phone: 1-888-283-6763 (available 24/7)

- Lost or Stolen Card: 1-888-282-6713

- Mailing Address: Amazon Credit Card Services, P.O. Box 6051, Sioux Falls, SD 57117-6051

- Online Support: Accessible through your Amazon account under “Your Account > Payment Options > Manage Credit Card”

- Email Support: Use the secure message center within your Amazon account

To Conclude

Applying for the Amazon Credit Card gives you access to rewards, cashback, and convenient payment options.

Understanding the fees, interest rates, and online management tools helps you make the most of your card.

Apply now through the official Amazon Credit Card website to start earning benefits on your purchases.

Disclaimer

This article is for informational purposes only and does not constitute financial advice.

Terms, interest rates, and fees for the Amazon Credit Card may change, so verify details on the official website before applying.